Consumers and businesses tend to fear recessions for good reason. They can wreak havoc on the economy, ignite tremendous financial pressures, and wipe out years of investment gains. But it’s not all bad, all the time.

Recessions aren’t fun. Jobs are lost, consumers and businesses default on debt and go bankrupt, and most asset prices take it on the chin. Depression and suicide rates even rise1. But they aren’t all bad, and before scoffing at the notion that there’s a silver lining from a recession, consider the following.

Recessions temper inflation and prices. Are you happy watching grocery bills increase monthly? Do you enjoy paying double or triple for hotel rooms? Is there a sense of satisfaction from dropping a couple grand to go to a Taylor Swift concert? If the answer is “no” to any of these, then a recession may be just what the frugal mindset craves.

Recessions purge excess out of the system. Treasury Secretary Andrew Mellon famously said the following to Woodrow Wilson during the Great Depression:

“Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.”

Recessions act as an economic reset. They encourage consumers and companies to save more and spend less.

Recessions facilitate Darwinism. They kill off bad ideas, eviscerate funding for future bad ideas, and improve the overall economic ecosystem as the strong get stronger. Well-run companies acquire poorly-run ones, and surviving businesses cut costs and become more efficient.

Recessions also catalyze innovation as companies look for new technologies and processes to streamline operations. Government and private sector investments in research and development tend to increase during recessions to stimulate economic growth.

Recessions force governments to act. Politics demand action to end recessions. The Federal Reserve cuts interest rates, and Congress passes legislation to stimulate a new wave of economic growth. These policy responses allow consumers and businesses to refinance debts at lower rates and encourage new investment into entrepreneurship and innovation.

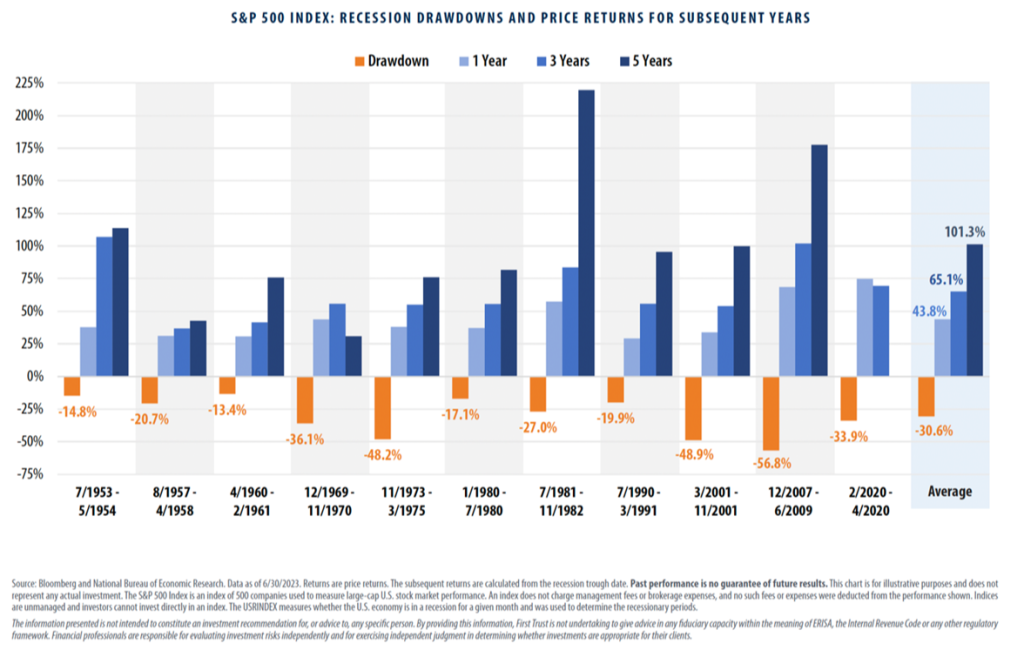

Recessions create opportunity. The chart below shows the performance of the S&P 500 around every recession over the last 75 years. The consistency is no coincidence. The average drawdown (blue-shaded area) has been a painful 30.6%, but a year later, the index has risen 43.8%. Five years later, it’s more than doubled.

Furthermore, the duration of recessions has been shrinking. The U.S. has experienced 34 recession cycles since 1854, lasting an average of 17.5 months. However, go back to 1945, and the average recession lasted 11 months2. This phenomenon is also no coincidence. Each recovery incorporates new lessons learned that create stronger foundations for future growth.

The bottom line

The U.S. economy is the greatest economic growth engine the world has ever seen. It was built to grow, it wants to grow, and when it’s not growing, it’s preparing for the next leg of growth. Here’s how we plan to invest through a recession, if one were to occur, that doesn’t require a crystal ball.

For starters, avoid running to cash because the odds of properly timing the exit and re-entry are incredibly low. “Staying the course” isn’t ideal either because if the economy is changing, so should investments. Instead, use slow, deliberate adjustments because migratory moves tend to lower the risk of having to make bigger ones down the road.

Additionally, target recession-resistant growth. Slowdowns won’t stop brilliant scientists from curing cancer. They won’t convince programmers to quit on artificial intelligence and quantum computing. Nor will they impede clean energy initiatives. There’s a tsunami of innovation fueling the economy over the next decade, so focus more effort here and less on highly cyclical sectors that demand impeccable timing.

The bottom line is that recessions are a feature, not a bug, of the economic cycle. They restore harmony to the balance of supply and demand, and profiting from this warrants a shift in strategy rather than a total abandonment of one.

Sincerely,

Mike Sorrentino, CFA

Sources

1 https://www.nytimes.com/2012/11/05/health/us-suicide-rate-rose-during-recession-study-finds.html

2 https://www.gobankingrates.com/money/economy/recessions-what-you-need-to-know/

Disclosures

This material has been prepared for informational purposes only and should not be construed as a solicitation to effect, or attempt to effect, either transactions in securities or the rendering of personalized investment advice. This material is not intended to provide, and should not be relied on for tax, legal, investment, accounting, or other financial advice. You should consult your own tax, legal, financial, and accounting advisors before engaging in any transaction. Asset allocation and diversification do not guarantee a profit or protect against a loss. All references to potential future developments or outcomes are strictly the views and opinions of Richard W. Paul & Associates and in no way promise, guarantee, or seek to predict with any certainty what may or may not occur in various economies and investment markets. Past performance is not necessarily indicative of future performance.